Bogus Rules

Sam's Problem is Now My Problem

The weakest link in the entire story about Sam’s “gentle” agenda to transform the humanity of which I am a part is how much his vision thing depends on humanity reproducing itself and staying employed.

Working matters because, well, individual income taxes fund about 50 percent of total federal revenue, and lots of people earning income enables governments to stay in power and even use taxpayer (my) money to take equity stakes in frontier technology companies, like quantum-computing firms, rare earth mining, and chipmaking. President Trump and Commerce Secretary Howard Lutnick have said the government should share in a company’s upside “since taxpayer money provides financial support and a stamp of approval”.

As a member of America LLC, my question is: where’s my cut?.

People earning an income also means they can pay their higher utility bills coming down the pike because of soaring electricity demand and water usage from the 5,500 data centers being built to sustain the big system feedback loop sparked by Sam.

These data centers consume the rough equivalent to the annual electricity demand of the entire nation of Pakistan.

They also use a huge amount of water — Amazon, which is planning to cut 30,000 corporate jobs , is the biggest owner of data centers in the world, dwarfing Google and Microsoft. (This may help explain Bill Gates’ “strategic pivot” around the risks posed by a warming plant; after spending billions of his own money to raise the alarm about the dangers of climate change, he is now pushing back against what he calls a “doomsday outlook” See his memo penned on Tuesday here: “Three Tough Truths About Climate.”)

Amazon is projecting its data centers will use 7.7 billion gallons of water a year by 2030, according to a leaked memo. (Amazon as a whole consumed 105bn gallons of water in 2021, as much as 958,000 US households, which would make for a city bigger than San Francisco.)

Families across at least 41 states are already experiencing electricity and natural gas bill increases, or will soon when utility companies’ proposed rate increases go into effect.

Per a Center for American Progress analysis, at least 102 gas and electric utilities have either raised or proposed higher rates that would go into effect in 2025 or 2026. Nearly 50 percent of the nation’s electricity utility customers (81 million) and more than one-third of natural gas customers (28 million) will be affected.

Bank of America economist David Tinsley believes “consumers are indirectly footing part of Sam’s bill for the AI boom through higher utility costs”. In his note, AI Sparks a Rise In Utility Bills (PDF) Tinsley details how average utility payments have risen this year:

“Average utility payments rose 3.6% year-on-year in Q3 2025, with Tinsley linking the increase to soaring electricity demand from data centers powering artificial intelligence. The build-out of infrastructure needed to support the AI boom — despite projects like the $500 billion Stargate initiative and massive investments by Microsoft, Google, and Nvidia — is straining the grid, driving up costs for all ratepayers, he said.

Despite GDP-altering investments, electricity supply is struggling to keep pace with demand, suggesting prices will continue to rise and pressure household budgets in the months ahead.'“

But there is good news, at least for the OpenAI-enabled-and-workforce-reduced financial services industry: The utilities sector is up about 43% since the end of 2023, making it the third best-performing group in the S&P 500, driven by the artificial intelligence trade.

The most striking feature of today’s AI industrial boom isn’t shareholder value or the speed of the buildout, or even the size of the data centers, it’s the casual ease with which people assume the economics will work, writes Dave Friedman in a recent Substack. Everyone from Sam Altman to Wall St analysts to armchair modelers assumes that $400 billion a year in AI capex will find its counterpart in roughly $400 billion of new AI-driven revenue, he says.

“The revenue bridge is a mirage.”

From Friedman’s perspective, hundreds of billions in annual capex can’t be justified by hypothetical $1,000-per-seat AI subscriptions or ad spend, and that the real asset is industrial, not digital. In other words, the AI-economy may end up building power grids, fab capacity, and logistics networks, which may all be civilizationally useful over the long term, but unkind to the near-term “digital” EBITDA story (for different perspective, see The S&P 500 are running out of ideas — and they can’t keep telling Wall Street that AI will fix all their problems, Blue Spoon’s commentary on leadership published last year in Fortune.)

OpenAI is generating just about $13 billion this year in revenue, which isn’t nearly enough to pay for the estimated $650 billion that it owes to its partners for all its computing deals, according to the Wall Street Journal. Altman has said in interviews that he expects a lot of it will be paid with revenue growth. But what happens if that growth doesn’t continue, if Sam’s conviction that revenue will grow with more computing power and demand will be there, what if that doesn’t happen?

On Friday, the Journal unpacked that question in a podcast, The Promise and Peril of Sam Altman’s Dealmaking:

That’s another question that is bubbling below the surface. It is this surreal effect where essentially investors’ expectations around AI are growing larger and larger, where the assumption is that OpenAI will continue to grow at these huge rates. If OpenAI doesn’t, if something comes out about OpenAI’s revenue growth slowing or any indication that the market might not be as big as OpenAI says it is, it’s very plausible to see a big sell-off in tech stocks.

And he’s tying the fates of a lot of the biggest cloud and chip companies to OpenAI.

Short-term ROI? Doubtful, dubious.

Long-term? probably massive and industry-reshaping, but that kind of market and economic development takes patience, and most Western companies and governments don’t have it, or haven’t learned the art of positioning and sustaining the long-term roadmap.

Ultimately, the apps will fade. The grid will remain.

This isn’t fatal so much as it means the narrative contagion surrounding, subsuming and giving AI its dialogue as lead actor on the stage needs editing, to “rhyme less with computer software and more with infrastructure” to enable computational imagination and big system change. Unless end users in business and government invent space for new profitable workloads, many business and governments will face a value capture overhang: a surplus of compute chasing too little rent. (Amazon’s AI infrastructure is running at just 12-18% utilization.)

Or the AI world may just find a full crowd scene at the food lines.

This the waiting place, where most of the infinitely-expanding galaxy of technology services vendors are standing now, struggling with the strategic physics, pitching LLMs that look and think like a rehash, if for no other reason than they’re based on internet (and, in the case of healthcare, retrospective claims) data that has already been scraped, cleaned, retrained and resold over and over again to death.

That’s why new releases feel flat, says Fawad Butt, co-founder and CEO of Penguin Ai. Fawad’s take on things is notable because he was a former Chief Data Officer at Kaiser, UnitedHealthcare and Optum, and at one point had oversight of nearly 70% all of America’s healthcare claims. There’s little new for these models to learn, he says in an op-ed for Medcity News a few days ago.

“Every cycle just recycles the same patterns back into the model. They’ve already eaten the internet. Now they’re starving on themselves.”

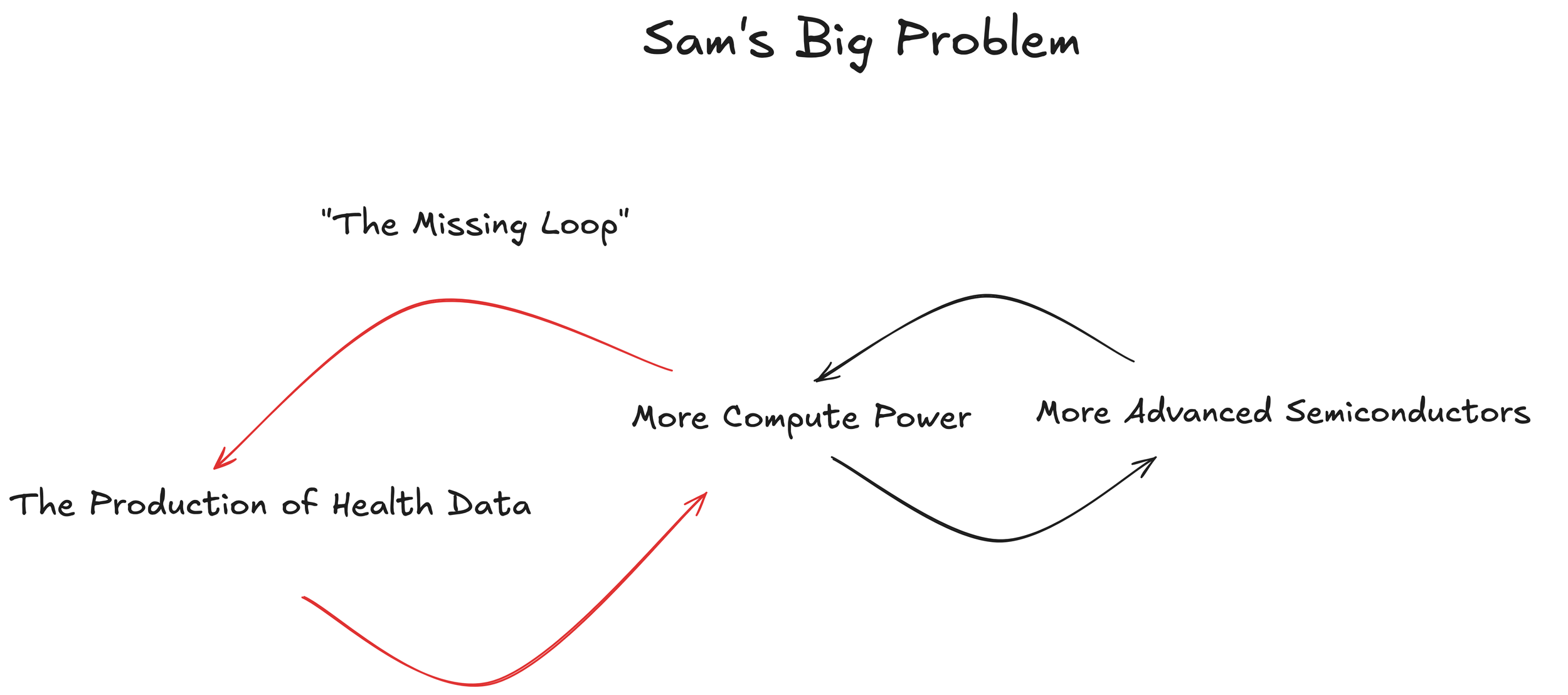

At a system-level, Sam’s problem looks like this:

Looking for real GDP-moving innovation?

Producing more fabs and more compute power is no longer the limiting reagent to sparking new growth curves. Combining economic systems to produce unique health data is.

The System That Refuses to Cooperate

Humanity sticking around to work and produce income is also helpful to Sam because it allows people to become consumers of all the physical goods “AI-mediated shopping” from Amazon or Walmart is intended to sell.

Like a bag of Protein Doritos, a cup of Starbucks® Protein Cold Foam, or for the healthy snacking segment, a box of Protein Pop-Tarts (slated for launch in November). These are the latest innovations from a new economic subsystem of products *designed* to be consumed with a GLP-1 drug, injections now available as a cash-pay option for $499 via LillyDirect, or $200 via Hims & Hers. It’s not hard for a woker-as-shopper-as-patient-as-consumer to see ‘the value’ of combining these protein-packing products with a CGM (around $400 a month in supplies).

How this ‘shopper’s basket’ of material goods — drugs + devices + nutrition-like objects — gets priced, packaged, filled and delivered to a consumer by an OpenAI-optimized supply chain, is a family-system question that deserves far more scrutiny than it’s getting, especially in light of a 30 percent increase in health insurance.

Paul Keckley in his latest post, Do Consumers Care about Healthcare Prices (Really)?

In September, a Harris poll found 40% of households have seen their monthly household expenses increase $500 to $749. Yale Budget Lab economists predict households will see an additional increase of $191/month as tariffs kick in and the economy adjusts. In tandem, layoffs by public and private sector employers (including hospitals and tech companies) are increasing and employer benefits costs are being shifted to employees.

KFF released an employer survey showing average family premiums rose about 6% in 2025 to roughly $26,993, with workers contributing about $6,850 toward the total. Employers are bracing for hikes approaching 9% in the absence of new limits, reinforcing the strain on benefits budgets and household finances.

We’re all stuck in a loop in time, recycling the same cycle of cognition, unable to “fix” the thing that is not fixable. Speaking of which:

Tricia Keith is the president and CEO of Blue Cross Blue Shield of Michigan. She penned an op-ed for the Detroit Free Press earlier this month (“Health care costs are rising. We need to reform the system”) that is notable not for its novelty and leading/leading-edge perspective, but the complete absence of ‘narrative surprise’ and new economy vision. Like nearly all executive content and communications nowadays, it’s the same assemblage of words constructing the same concepts of reality to sustain an increasingly fragile status quo.

To wit, an extended excerpt:

“The affordability of health insurance is severely strained right now, with premium increases in the double digits being passed along to many Michiganders for the past several years in a row.

Skyrocketing medical and drug costs drove Blue Cross Blue Shield of Michigan’s claims expense higher by $12 million per day in 2024.

The cause? Drug makers can price their products with no regulation, and enjoy patent protections that keep lower-cost competitors out of the market. This is a government-sanctioned monopoly and must be reformed to encourage competition that lowers costs.

As we all know well, there is also drug advertising. In just the first three months of this year, drug makers spent $729 million on television advertising to drive demand for their high-priced products. In 2024, they spent $5.3 billion on television ads. And it’s all tax-deductible.

Recently, the current administration announced a proposal to rein in TV advertising for prescription drugs. Why does this matter? Direct-to-consumer advertising for prescription drugs increases patient demand, which raises the ability of manufacturers to negotiate higher prices for already expensive drugs. Meaning these higher costs impact individuals and businesses downstream.

The Blue Cross and Blue Shield Association supports a proposal to eliminate the tax deductibility of pharmaceutical advertising, saving $137 billion from 2026-2035. The bottom line is, we need to reform this system that drives drug prices — and health insurance premiums — higher.”

No surprise there.

Tackling this affordability crisis isn’t something we can do alone, says Keith. “It requires partnerships — across health systems, providers, insurers, regulators and pharmaceutical companies — to address the root causes of rising costs.”

No surprise there either.

Besides the lazy halo that has become the hallmark of healthcare content, the ‘ectoplasmic generalities’ around which you can’t really argue, Keith’s narrative also suffers from a fragmented framing, her storyline of benefit (and blame) completely, if not intentionally, missing Big PBMs + Big EBCs as “root cause” in the current disfiguration of how value is created and controlled, how health is produced, and even how medicine is practiced in the United States:

Keith and her PR team aren’t incorrect.

Getting out of a “crisis” takes “partnership” — but her storyline is half-baked and under-conceptualized; it’s devoid of new energy to get big things done. “System reform” takes different management skills, unique navigational knowledge to propagate and curate a better system-reshaping vision, one that’s positioned on value alignment and market interoperability: getting longtime enemies to choose mutually assured dependence over mutually-assured destruction.

The thing ‘our moment’ needs is a new reference point that solves for ‘innovation diffusion’ and access to physical products. That abandons the idea of zero-sum competition.

That looks at that big wave and says, "Hey, bud, let's party!"

Righteous Bucks

Sam Altman’s wheeling and dealing has put OpenAI at the center of the AI superbloom, but it’s also put all of us — including roughly $35 trillion in global wealth, part of which includes my and my family’s retirement/investments — in a precarious position. He has managed to tie the fates of the world’s largest semiconductor and cloud companies to his own company.

The Journal’s Berber Jin:

“[Altman] was a venture capitalist before becoming CEO of OpenAI. He’s very good at selling a vision as well, and he has these very natural qualities of a deal maker.

And more specifically, a lot of these deals come down to very basic element of human psychology, which is just like the fear of missing out….So it very much is this dance where he’s daring each player to go bigger and promising them that if they buy into his vision for OpenAI, they could end up making a lot of money. And then the people who are more cautious, he’s making them a little nervous because he’s finding other people who are willing to take the bigger bet.”

Sam’s vision problem is a form of myopia from not seeing that we’re all swimming in the same ocean, in the same system. Something Jeff Spicoli grasped intuitively:

Mr. Hand: Am I hallucinating here? Just what in the hell do you think you’re doing?

Jeff Spicoli: Learning about Cuba, and having some food.

Mr. Hand: Mr. Spicoli, you’re on dangerous ground here. You’re causing a major disturbance on my time.

Jeff Spicoli: I’ve been thinking about this, Mr. Hand. If I’m here and you’re here, doesn’t that make it our time? Certainly, there’s nothing wrong with a little feast on our time.

Mr. Hand: [takes away box of pizza from Spicoli] You’re absolutely right, Mr. Spicoli. It is our time. Yours, mine and everyone else’s in this room. But it is my class.

A mass unemployment event isn’t something to aim for.

There’s more than one way of digitizing economic and cultural activity, of powering new flows and production chains and different patterns of consumption, to give people access to the good stuff their data helps invent. But the current configuration will do more to shrink the economy, while concentrating wealth and power in ways that are not sustainable.

I’m more than happy to help Sam Altman add another $1 billion to his personal net worth, because if Sam is successful, that means I can be successful. And I’m not troubled that “government” is now taking equity stakes in businesses (i.e., ‘state capitalism’). The thing that bothers me is that I as a taxpayer, and proud member of America LLC, am not getting a cut of the upside from the next big money economies my data is being used to create, data that Sam needs to power his humanity-saving-workforce-reducing vision.

The new innovation agenda is the one that creates and sustains access to the middle class. Capitalism only works if there are enough successful people to be the customers. And a better market-based system can only be sustainable when the accounting is thorough enough to reflect where value comes from.

The next deal-making meeting with the Trump administration, or the next op-ed for Blue Cross/Blue Shield of Michigan (or UnitedHealthcare) to write, should be one co-authored by OpenAI (or Anthropic) and Eli Lilly (or Novo Nordisk) framing a new industry narrative — and trillion-dollar investment agenda — to make an information-age middle class come into being.

Because I suspect we’re all about to get slapped hard by Sam’s gentle hands.

/ jgs

John G. Singer is Executive Director of Blue Spoon, the global leader in positioning strategy at a system level. Blue Spoon specializes in constructing new industry narratives.